04Making sense of the business support offer

Today there are around 900 national, local, private and public sector and EU-funded business support initiatives in the UK. The state-funded initiatives are spread across several central government departments and non-departmental bodies and managed at national, regional and local level.

This diversity and lack of structure makes it hard for anyone to understand the extent and the coverage of services government offers.

After the business support system organised around the RDAs and the Business Link was scrapped the Government has introduced two further policies that can be seen as cornerstones of the new business support system:

- The Regional Growth Fund (RGF) is a vehicle for allocating public money to support business expansion and creation of sustainable jobs and to fund other local and national business support programmes. The RGF is now into its fourth round of bidding, and the size of the fund has been extended several times since the original announcement, reaching a total of £2.4 billion. The Fund allocates money to large scale projects run by individual businesses or to programmes aimed at supporting small businesses in a given area of industry. Since Round Three it has officially prioritised projects in the North of England and in the manufacturing sector.

- Enterprise Zones (EZs) bring together incentives aiming to encourage business growth in selected localities. Incentives provided to businesses that expand in the EZs include: business rates relief; simplified planning procedures; business-ready infrastructure, including fast broadband; and, for some Zones, capital allowances. Incentives became available in 24 English EZs in April 2012. It will take time for developments to take place and businesses to move, so it is too early to evaluate their impact.

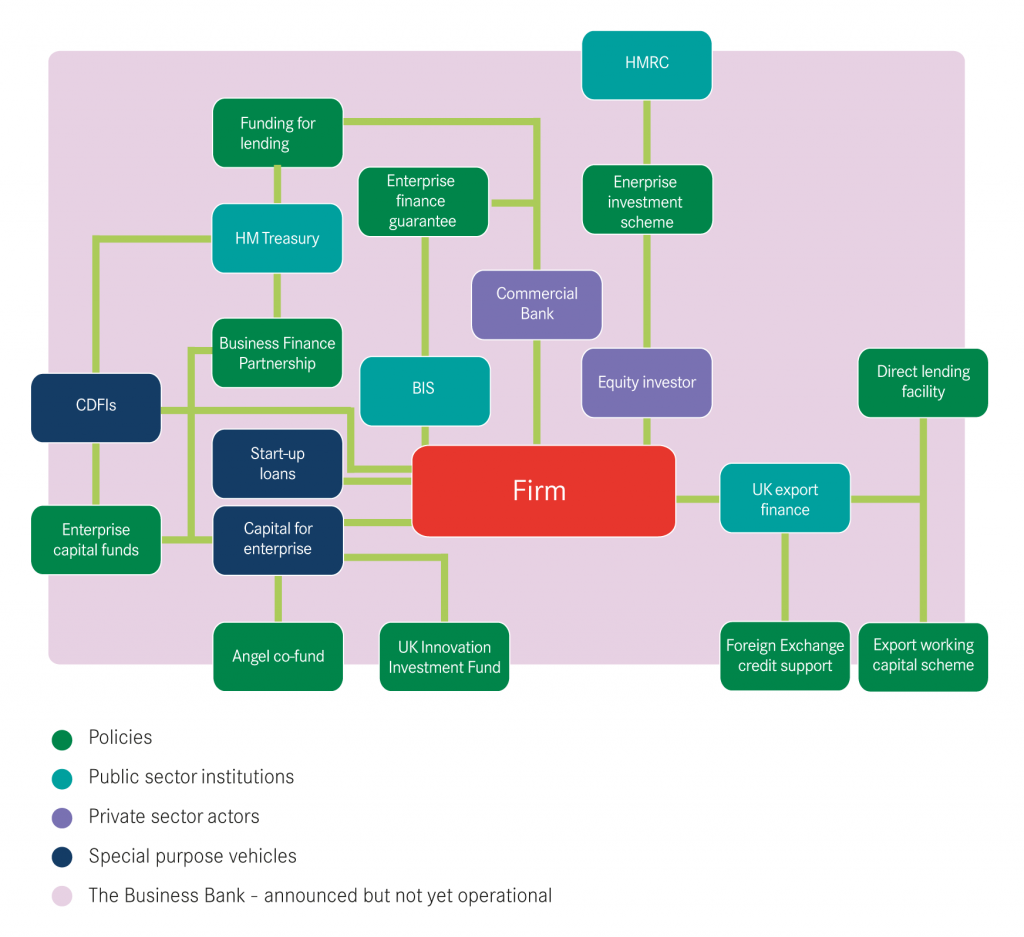

In addition to these major schemes, a number of smaller scale initiatives have been introduced at the national level, while a number of old schemes were maintained. Even though the number of initiatives has decreased, the business support landscape remains incredibly complex. Figure 3 presents the diversity of options that national policy offers to a business looking for finance to expand. The figure presents the complexity of the institutional structure and the difficulty of navigating the system that a firm is facing.

The remainder of this chapter presents a structured overview of national business support policies. First it offers two classifications for national business support policies that could help businesses and other stakeholders to navigate the system.2 It then assesses the geography of business support and looks at several local initiatives to present an example of the diversity of business support provided locally.

1. What services are available?

The tools that business support initiatives use are diverse, yet they can be aggregated into the following broad groups:

- Access to finance: helping businesses access debt or equity finance. Access to finance: helping businesses access debt or equity finance.

- Funding: provision of grants for business activities that are pre-commercial, yet may deliver significant economic benefits in the future.

- Tax reliefs and discounts: modifications to normal tax regulations that incentivise business to make decisions that produce public economic benefits, but are not feasible under the normal regulatory framework. This may include incentives to invest in skills, capital assets, research and development (R&D) or other high risk projects.

- Advice: provision of consultancy services to businesses, usually delivered by business advisers employed by public sector agencies or a contracted private consultancy.

- Networking and collaboration: facilitating contacts and joint working between businesses and other institutions (e.g. universities) to encourage exchange of knowledge and experience.

- Skills: incentivising businesses to invest in employee skills.

Figure 4 lists all the initiatives reviewed for this briefing, and identifies the tools each initiative uses.

*all of the UK Export Finance schemes are grouped together for simplification, for more details see Annex 1.

Finance-related tools are most frequently provided by the business support policies covered in this briefing. Interviewees suggested that the problems associated with improving access to finance are extremely complex. They include various issues: high levels of risk aversion among traditional lenders; a lack of long-term credit options; the underdevelopment of non-traditional finance vehicles; and a lack of capacity within businesses. The current government offer targets a number of these problems, but interviewees suggested that policies are rather fragmented and coordination could be improved which, according to those interviewed, is one of the tasks for the Business Bank. (Box 1)

Funding is the second most frequently-provided support tool. Grant funding is mostly offered by initiatives that focus on promoting innovation and R&D, mainly as these are the areas where returns on investments are hard to predict and finance tools are not always suitable. Several interviewees pointed out that it is extremely important that schemes that provide grant funding complement rather than substitute debt and equity finance tools, otherwise they can distort market incentives and have a negative impact on productivity.

Advice (as defined in this briefing) is a very broad category that includes a number of information provision and consultancy services. Some schemes reviewed provide niche advice, related to a particular issue such as identifying suitable markets for export (Passport for Export), or making manufacturing processes more efficient (the Manufacturing Advisory Service). Others provide a broad range of general business and management advice (Growth Accelerator, Business and IP Networks). Components of these services appear to be overlapping and there is a strong case for collaboration between providers, as well as joint work to help businesses navigate the different offerings.

Box 1: The Business Bank

The Business Bank was announced in September 2012 and allocated £1 billion, but many details about this new institution remain unclear. It is apparent, however, that it will not be a bank in the traditional sense. It will not have high street branches but will be an institution taking over the responsibility for promoting, managing and delivering all existing state-backed equity and lending schemes. It is likely that the bank’s direct engagement with businesses will be very limited, but it will work actively with existing commercial banks and use them as vehicles for channelling support and understanding business needs.

The British Chambers of Commerce has suggested that, apart from administrating all access to finance initiatives, the Bank should also act as a lender of last resort for businesses. Other commentators have proposed that the Business Bank should target the problem of availability of long-term credit, lead on restructuring all policies related to access to finance or even become the coordinator of all business support initiatives.

Whatever the particular list of responsibilities and institutional structure of the Bank, it is extremely important that it is clear to businesses what it does and that it consolidates existing initiatives, thus simplifying the system rather than adding a new layer to it.

In the 2013 Budget, the Chancellor of the Exchequer confirmed that the Business Bank will become operational in 2013 and will deliver business support to Small and Medium Sized Enterprises (SMEs) before the end of 2014. It has also been announced that £300 million of the £1 billion budget of the Bank will be invested to target the gaps on SME finance market and support non-bank lending mechanisms, and £75 million will be spent to expand the Enterprise Capital Fund and the Business Angel Co-Fund. On 10 April, Vince Cable announced the first phase of the Business Bank and revealed that it will not lend directly to businesses but will operate via private sector institutions. However, there was no further clarity on how the Bank will be organised, nor its broader role in consolidating finance-related business support.

The Government’s recent response to the Heseltine Growth Review mentioned that the Bank will address gaps in provision of finance to SMEs, including the availability of patient long-term capital.

Networking and collaboration tools encourage knowledge exchange and innovation, facilitate more trading and help develop supply chains. Most of the initiatives reviewed focus on encouraging collaboration between businesses and universities. For example the Knowledge Transfer Partnerships (Box 2) is an initiative that has been running for nearly 40 years and has shown good results. But the creation of a number of university business partnerships means that it is hard to distinguish between the remits of Knowledge Transfer Networks, Catapult Centres and Innovation Knowledge Centres.

Box 2: Knowledge Transfer Partnerships

Knowledge Transfer Partnerships (KTPs) are an example of a business support scheme that has been running since 1975 without major changes. The scheme brings together a business and a research institution to work jointly on a research project, and a recent graduate who is hired to coordinate the partnership. With 1,000 partnerships running at any given time, KTPs have reached a significant scale and has been sustained through the years largely because of their creative design and ability to adapt to varying needs of businesses.

The tax incentives currently on offer target Small and Medium Sized Businesses (SME) and start-ups. Employer National insurance Contribution (NIC) holidays provide a £5,000 discount to firms that meet certain criteria. The Enterprise Investment Scheme provides a range of tax incentives for investing into small high-risk companies. The Enterprise Management Incentive provides an opportunity for small firms to award their employees with share options that are subject to taxation with a discount.

The Budget 2013 has introduced further measures to incentivise investment in small dynamic businesses. The Capital Gains Tax holiday gives investors a 50 per cent tax discount on their 2013/14 capital gains. if the profits are reinvested in SMEs before the end of the 2014/15 financial year. The abolition of stamp duty on companies quoted on growth markets, such as the Alternative Investment Market, has the potential to unlock more funding for small businesses and the new employee-shareholder status provides SMEs with another tool to retain employees.

Support for SMEs is definitely welcome, but it appears that the new initiatives are actually just modifications of schemes that are already available and do not offer anything substantially innovative. At the same time, they increase the number of initiatives, thus adding an extra layer of complexity.

2. What are the aims of business support programs?

All business support initiatives, no matter which tools they use and how they engage with businesses, ultimately pursue one of the following three objectives:

Helping businesses grow. A number of businesses have the capacity, products and aspiration to grow, but face barriers that stop them from expanding. The barriers may include lack of information about new markets; inability to find a larger workspace or additional power capacity, lack of resources needed to buy capital equipment, or inability to hire more staff. Policy initiatives that fall into this group aim to address these and other barriers to growth through improving access to finance and advising on export trading.

Making businesses better. Businesses often lack the capacity, skills, knowledge or networks to make them more competitive and more productive. Policies in this group target these issues by helping businesses become more innovative, share ideas or access knowledge, develop and retain skills.

Increasing the number of businesses. A healthy economy needs businesses to replace those that die. The more businesses there are in the economy, the more competitive and efficient it will be. Support therefore aims to encourage people to become entrepreneurs, and provides advice and support at the early stages of business development.

Figure 5 allocates all of the 43 initiatives reviewed in this briefing to one of the groups defined above, or several groups in the case of more complex initiatives.

The figure shows that a large number of programmes appear to have similar objectives, but differ in tools and target audiences, which suggests that issues of coordination and duplication deserve special attention. Duplication may be caused by different policies applying similar tools for different purposes. In such a fragmented landscape, coordination between institutions delivering support becomes crucial.

For example, the Technology Strategy Board (TSB), UK Trade and Investment (UKTI), Growth Accelerator, Start-Up Loans Company, the British Library and the Intellectual Property Office (IPO) (see Box 4 for more information on business and IP network initiatives) all provide advice to businesses that should have complementary elements. Yet interviewees pointed out that, while there are instances of collaboration between these institutions (examples of joined work between the TSB, Growth Accelerator and UKTI were mentioned), there is still significant scope for improvement.

Over a half of the programmes reviewed, such as R&D tax relief, the Export Communication Review or the New Enterprise Allowance, have a very narrowly defined focus area. This creates a danger of gaps and poor adaptability. Even 40 narrowly focused initiatives may fail to provide comprehensive coverage, as they are hard to change even when new barriers to business growth emerge – such as a lack of people with relevant skills on the labour market.

Alongside very niche initiatives, such as Direct Lending Facility for Exporters or Innovation Vouchers, there are complex initiatives that use a vast array of tools and target a number of different issues, such as the Growth Accelerator discussed below (Box 3). This creates another layer of potential confusion because certain services, such as advice on commercialising innovation, can be accessed both through focused schemes like Innovation and Knowledge Centres, or through large schemes like the Growth Accelerator.

Box 3: Growth Accelerator

The Growth Accelerator was announced by the Government in May 2012. It was allocated £200 million and set the task of helping up to 26,000 businesses. The programme is funded by the Department for Business Innovation and Skills (BIS) but managed by a special purpose vehicle called ‘Growth Accelerator’ that also attracts private funding. It provides a variety of services to SMEs that have the potential to double in size within the next three years. As reported on the its website, the programme offers the services of 800 experts to help businesses in accessing finance, developing leadership skills and commercialising innovation. The services provided include most categories of business support. This broad approach may be beneficial for participant businesses but it seems that, rather than coordinating with the rest of the business support offer, Growth Accelerator has created a separate system of its own. Coordination with other services will be required in order to ensure that the programme delivers good value for money.

Box 4: Business and IP network

The British Library Business and IP Centre was launched in 2006 and since then has been used by 300,000 entrepreneurs. The initiative targets entrepreneurs at the pre-start-up phase of development. It helps them test their business ideas and provides information and advice necessary to successfully start an innovative business. Services include general advice, market research, help with data collection, and support with intellectual property protection. Following the success of the scheme, Department for Communities and Local Government (DCLG) provided funding to roll it out to libraries in six core English cities: Birmingham, Leeds, Liverpool, Manchester, Newcastle, and Sheffield. The programme is a good resource both for entrepreneurs and for those considering starting a business. It provides a clear access point and an environment where all the information needed to develop a business idea is available. Yet a number of services, including general advice and IP support, duplicate other programmes such as the Growth Accelerator. And, as the administrators of the programme have admitted, coordination with other business advice programmes has been patchy so far.

3. What is the geography of business support?

Most of the businesses support initiatives provided by the Government target a market failure specific to an industry or firm of a particular size and stage of development. These policies are space-blind.

Some initiatives, however, are place-based, in that they are designed to target particular geographic areas. The RGF is an example of an initiative that, although available to businesses all over the country, prioritises certain areas through its allocation process. EZs and Launchpad are examples of ring-fenced initiatives, which only target businesses within specified boundaries. Business and IT networks and Catapult Centres are examples of initiatives that are organised around a physical access point established in selected locations.

Figure 6 shows the locations of a small number of selected place-based initiatives.