05The geography of jobs in the Gatwick Diamond

Different parts of a local economy play different roles within it – some are centres of employment, others are centres of population, while others have little of either. This section looks at the distribution of jobs across the Gatwick Diamond to better understand the geography of its economy and within it, the roles that different places play.

Where jobs are located across the Gatwick Diamond

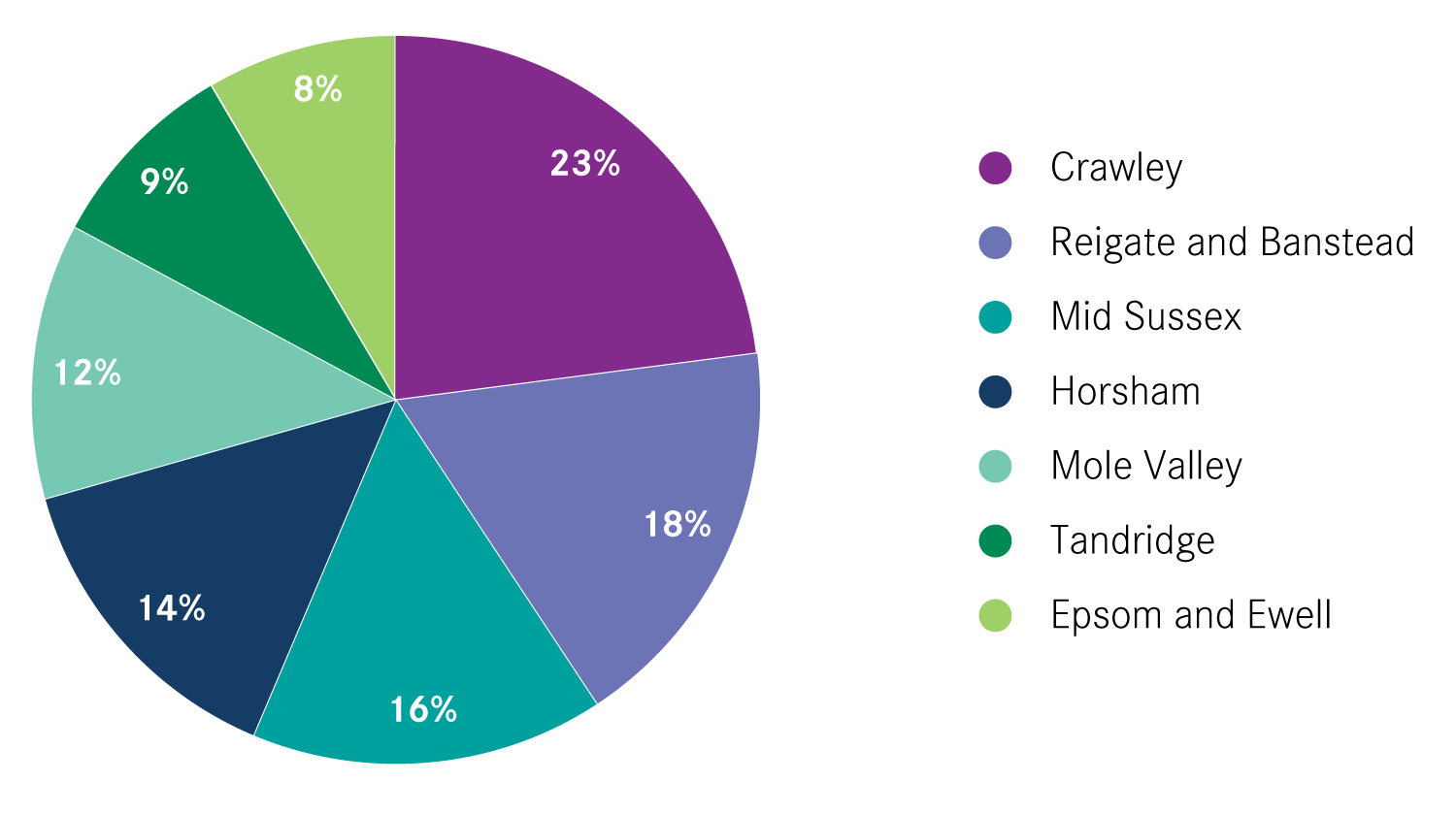

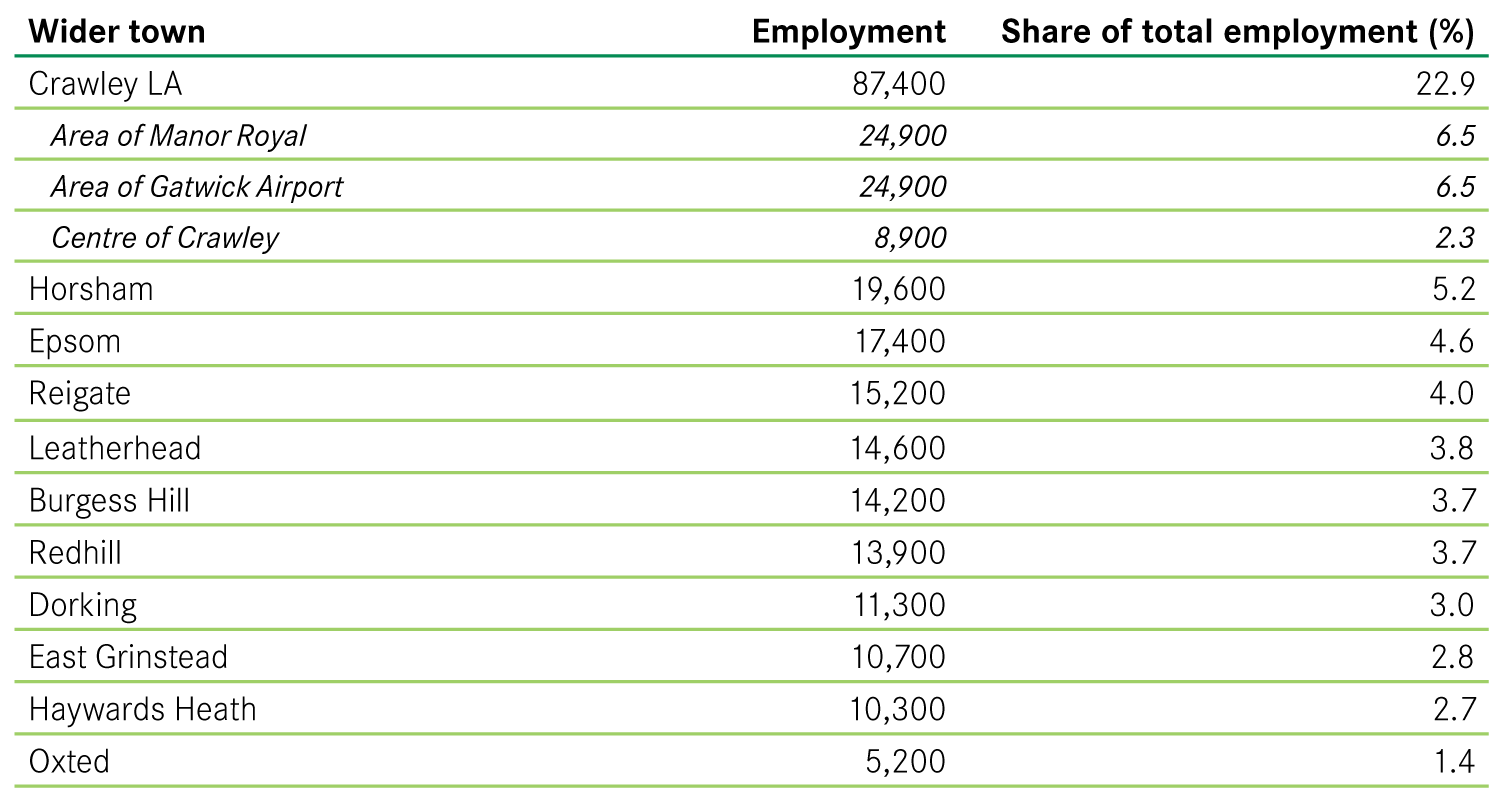

The economy of the Gatwick Diamond is highly concentrated in Crawley. On a local authority basis, Crawley is home to the largest share of the area’s jobs – as Figure 11 shows, over one in five jobs is located in Crawley district, followed by the districts of Reigate and Banstead (18 per cent) and Mid Sussex (16 per cent).

There is greater variation still when looking below the local authority level. Figure 12 shows the location of jobs across the whole of the Gatwick Diamond at a lower geography, revealing the economy to be ‘spiky’, with jobs concentrated in specific areas.

As can be seen, the areas that include Manor Royal and Gatwick Airport both had by far the largest concentration of jobs, with each having close to 25,000 jobs based within them. This means that each area accounted for 6.5 per cent of the total number of jobs in the Gatwick Diamond, despite covering one per cent of the land.

Looking at other large concentrations in more details shows that:

- The rest of the Crawley area accounted for a further 37,600 jobs. Within this the centre of Crawley was home to 8,900 jobs on its own.2

- Horsham was the third largest employment area, with 19,600 jobs. Within the town 62.6 per cent of jobs were located in the area that covers the centre of Horsham. In contrast, the areas that include Parsonage Business Park and Broadlands Business Park both had around 3,000 jobs, meaning they accounted for around one-third of all jobs in Horsham town3.

- Broadly similar in size to Horsham, Epsom had around 17,400 jobs, with close to 70 per cent of these jobs located in the area that covers the town centre. A similar picture is seen in Reigate (home to around 15,000 jobs), where 70 per cent of the jobs were located in and around the town centre, while 30 per cent were in the area that covers Albert Road North estate.

- Leatherhead, Burgess Hill and Redhill follow, with respectively 14,600, 14,200 and 13,900 jobs. Contrary to other areas, the area that covers Victoria Business Park in Burgess Hill had more jobs than the central area (about 7,800 against 5,600). In Redhill, however, the area that covers the town centre had slightly more jobs than the area that encompasses Holmethorpe Industrial Estate, Foxboro Park and Kingsfield Business centre.

Overall this shows that jobs are not only concentrated in specific towns, but that within towns the largest job concentrations are usually to be found in the central areas, rather than in the surroundings.

As in the Gatwick Diamond, the geography of the comparator areas is ‘spiky’ too, with jobs concentrated in specific areas. Three interesting points can be highlighted.

First, there is a greater degree of concentration of jobs in the Gatwick Diamond than in the other areas. One third of all jobs in the Diamond were concentrated in only 2.3 per cent of the land area, led by the concentrations at Manor Royal and the airport. By comparison, in Greater Medway, a third of jobs were clustered on 7.7 per cent of the land, and in the Thames Valley Berkshire, they covered 13.5 per cent of the land.

Second, the main central areas play relatively different roles in each geography. For instance the city centres of Milton Keynes and Reading, in the SEMLEP and the Thames Valley Berkshire respectively, accounted for the greatest share of jobs of any area in their economies. As Figure 12 shows, the centre of Crawley, which accounted for 2.3 per cent of all jobs in the Gatwick Diamond, played a much smaller role, as did the centre of Aldershot in Enterprise M3 and the centre of Chatham in Greater Medway.

Finally, like the Gatwick Diamond, a number of business parks made a significant contribution. In Enterprise M3, the area that covered Solent Business Park and its surroundings, near Winchester, was the largest employment site. In the SEMLEP, the area that covered Brackmills Industrial Estate was the third largest employment area, with 2.6 per cent of all jobs. In the Thames Valley Berkshire, several business and industrial parks made relatively large contributions, such as Newbury and its surroundings, which covers Greenham Business Park (4 per cent of jobs altogether), Slough Trading Estate (4 per cent), and Green Park Business Park near Reading (2.8 per cent).

KIBS jobs are more concentrated in a few places

This geography of total jobs however hides differences between the locations of different industries. In particular, the location of knowledge-based services jobs, whose importance was discussed in the previous section, follows a slightly different pattern to the rest of jobs.

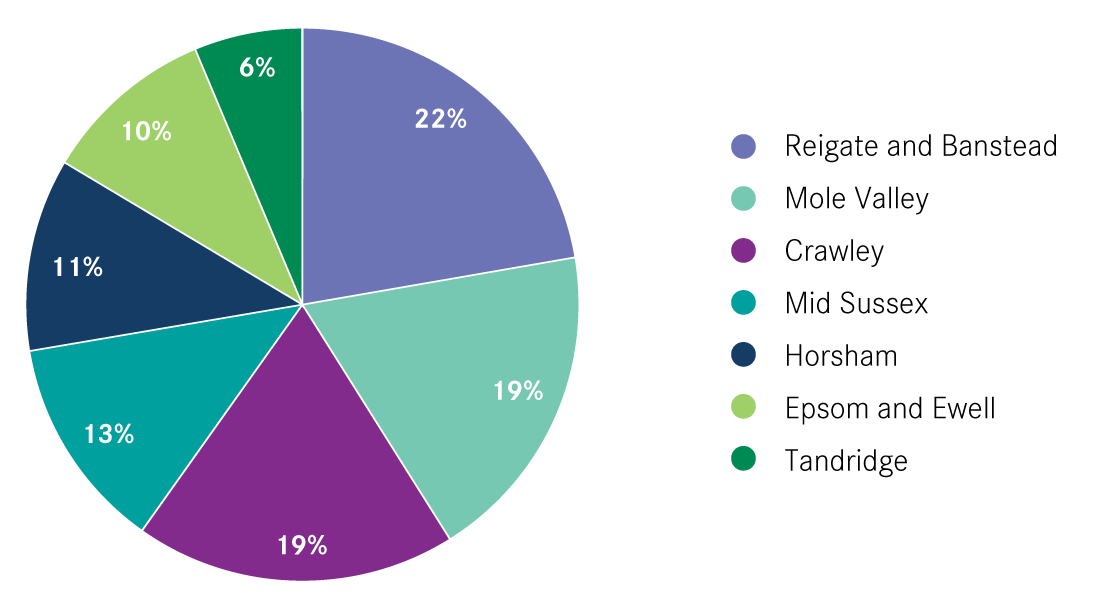

At the local authority level, the geography of knowledge intensive business services (KIBS) jobs does not reflect the geography of all jobs. As Figure 14 shows, Reigate and Banstead had the highest share of these jobs, with 22 per cent of all the KIBS jobs in the Gatwick Diamond, followed by the Mole Valley (19 per cent). Crawley local authority, despite being the largest local authority in terms of all jobs (with 22.9 per cent of all jobs), accounted for 19 per cent of the Diamond’s KIBS jobs.

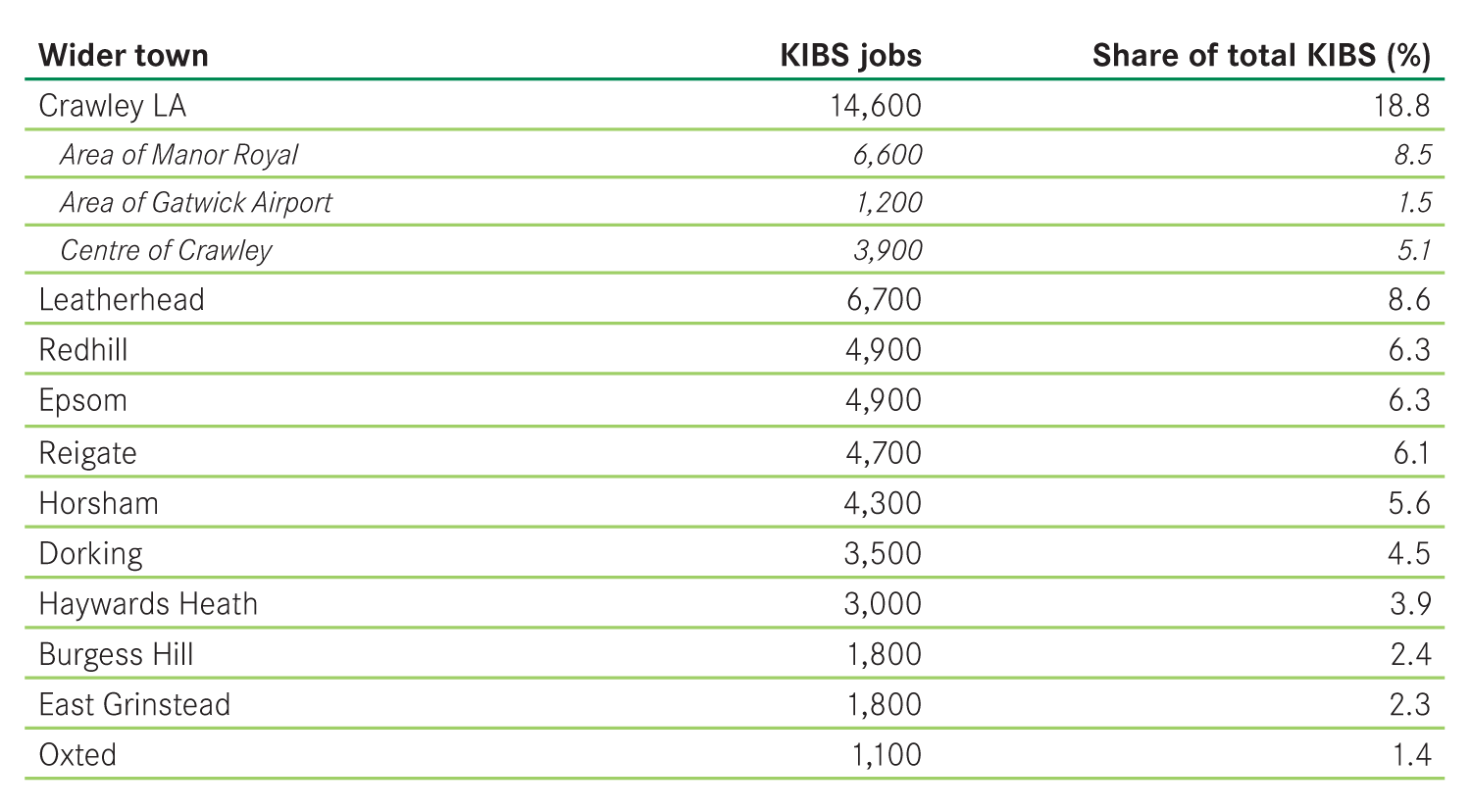

Looking once again below the local authority level shows that KIBS jobs are even more concentrated than total jobs. Half of knowledge-intensive jobs are located in just 3.3 per cent of the land area, and Figure 15 sets out what the geography of jobs looks like. There are a number of things to note.

Firstly, the majority of these jobs are clustered in the north of the Diamond, reflecting the larger share of jobs in the Mole Valley and Reigate and Banstead local authorities.

Secondly, the areas that cover Manor Royal and Leatherhead accounted for the largest number of KIBS jobs. Both areas had around 6,600 knowledge intensive services jobs, which represented about one in ten KIBS jobs in the Gatwick Diamond.

These two areas were followed by the towns of Redhill, Epsom, Reigate and Horsham, with around 4,300 to 4,900 KIBS jobs in each (accounting for around 6 per cent of Gatwick Diamond’s KIBS jobs each). Smaller KIBS jobs concentrations were found in Dorking (4.5 per cent of total KIBS jobs), Haywards Heath (3.9 per cent), Burgess Hill (2.4 per cent) and East Grinstead (2.3 per cent).

In each of these towns except Epsom, the central and densest area had a larger number of KIBS jobs than the surrounding areas that cover business parks and industrial estates. In Redhill for instance, 70 per cent of knowledge intensive jobs were located in the central area, while the area that covers Holmethorpe Industrial Estate, Foxboro Park and Kingsfield Business Centre accounted for the remaining 30 per cent. In Horsham, 24 per cent of knowledge intensive jobs were located in Parsonage and Broadlands business parks, against 72 per cent in the town centre. In Burgess Hill, Victoria Business Park was home to around 32 per cent of knowledge-intensive jobs, while the rest were located in the town centre.

Finally, the centre of Crawley had a relatively large number of knowledge-intensive services jobs (3,900 jobs), accounting for 5.1 per cent of the Gatwick Diamond’s KIBS jobs. While this was more than the towns of Dorking, Haywards Heath or Burgess Hill, it was lower than the towns of Epsom, Redhill, Reigate and Horsham. But this is still notable given the geographical definition used: as explained in Box 1, the centre of Crawley as defined in this report is a very tightly bounded geographical area, much smaller in size than other areas. The fact that such a small area is home to a high density of knowledge-intensive jobs suggests that it might provide attractive fundamentals to businesses.

Looking at comparator areas shows similar trends. First, town and city centres tend to see a larger concentration of KIBS jobs than they do for all jobs.

- In Greater Medway, the centre of Maidstone accounted for 15.1 per cent of the area’s KIBS jobs, much higher than its 6.4 per cent share of all jobs. At 4.2 per cent, Chatham city centre had the second highest share of KIBS jobs.

- In the SEMLEP, the city centre of Milton Keynes accounted for 12 per cent of KIBS jobs (compared to 4.7 per cent of all jobs), while the centres of Aylesbury Vale and Northampton were also in the top areas for KIBS, each accounting for 3.3 per cent of the SEMLEP KIBS jobs.

- In the Thames Valley Berkshire, the city centre of Reading accounted for 7.8 per cent of the area’s KIBS jobs (compared to 4.9 per cent of all jobs), followed by the centre of Slough (4.4 per cent of the Thames Valley KIBS jobs).

- In Enterprise M3, the centre of Woking had the highest share of KIBS jobs in the area (4.7 per cent), compared to 2.1 per cent of all jobs. However this was not significantly higher than the area of Solent business Park (3.8 per cent), Guildford town centre (3.4 per cent) and Basingstoke town centre (3.3 per cent).

Second, the largest job areas, in terms of total jobs, are not necessarily those with the highest number of knowledge-intensive jobs.

- In the Thames Valley Berkshire, the area covering the Young Industrial Estate and Thatcham Business Village, despite being one of the largest employment areas, only accounted for 1.4 per cent of all KIBS jobs. Similarly, Slough Industrial Estate – which had more jobs than the city centre – had a lower share of KIBS jobs (2.2 per cent and 4.4 per cent respectively). On the contrary, the area of the Winnersh Triangle business park had the third highest number of KIBS jobs in the Thames Valley (4.2 per cent, after Slough city centre) despite being a relatively small employment area (2 per cent of all jobs).

- In the SEMLEP, the town centre of Aylesbury only accounted for 1.5 per cent of all jobs but had the third largest cluster of KIBS jobs (3.3 per cent of all KIBS jobs). This said, the large employment area of Brackmills Industrial Estate, was also one of the biggest location for KIBS jobs (2.7 per cent of all KIBS jobs).

- In Enterprise M3, the centre of Woking accounted for the largest share of KIBS jobs (4.7 per cent) despite not being the largest employment area. Similar to Brackmills, Solent Business Park was a large KIBS area as well as a large overall employment area.

Overall this broadly shows three different types of employment areas: city and town centres (which usually account for a large share of total jobs and a large share of KIBS jobs), business and industrial parks with a high concentration of KIBS jobs (such as Manor Royal in the Gatwick Diamond, Brackmills Industrial Estate in the SEMLEP and Solent Business Park in Enterprise M3), and business and industrial parks with a low concentration of KIBS jobs (such as Thatcham Business Village and Young Industrial Estate in Thames Valley Berkshire, and Victoria Business Park in Gatwick Diamond).

Why do we see this happen?

Different places across the UK offer different attributes to businesses. Rural areas tend to offer access to countryside and cheap land, but they struggle to offer companies large numbers of potential workers from which to recruit. Unlike rural areas, the suburbs of and hinterlands around urban areas do offer access to large numbers of workers. Urban centres also offer access to a large number of workers, but in addition they also offer density, which gives them access to clients, collaborators and even competitors. Of course there are downsides to this type of location too, such as restrictions on space and potential issues around congestion.5

Where individual businesses choose to locate depends on how they value the different attributes that different places offer. Manufacturing businesses, for example, require access to a lot of land, which is constrained in urban areas. At the same time, they require access to lots of workers, which means they tend to prefer either a suburban or hinterland location. Even within this we see a split – lower-skilled manufacturing businesses look for cheap land and access to large numbers of lower-skilled worker, meaning that they tend to prefer suburban or hinterland locations in the North. Meanwhile high-skilled manufacturers need access to lots of high-skilled workers, and so tend to be based in the Greater South East.6

More knowledge-based services activities tend to put a greater emphasis on density. This is because of the benefits that density brings, namely the ability to access information provided through face-to-face interaction with clients, collaborators and competitors which increases their productivity (known as ‘knowledge spillovers’).7 And work by Centre for Cities has shown how this preference has increased in recent years, with KIBS jobs increasingly concentrating in Britain’s most successful city centres.8 Box 2 gives two specific examples of where this has happened in the Gatwick Diamond.

Box 2: The relocation of Grant Thornton and PwC

The professional services firms Grant Thornton and PwC have both moved their operations from Manor Royal and the airport respectively to the centre of Crawley in recent years. The reasons given by both businesses were very similar – access to the train station to serve their wider regional markets was important, but this was complimented by a number of other reasons, such as access to the hub of business services firms present in the centre, networking opportunities and the greater access to local amenities, which is likely to help with staff attraction and retention.

“There is clearly a lot of investment happening in the town centre. With all the new developments, excellent transport links and easy access to Gatwick airport, Crawley is a vibrant town with great potential for businesses. We are proud to be based here and a part of a thriving business community.”

Nick Jones, Office Senior Partner for PwC’s Gatwick office

Density in the Gatwick Diamond is by far the highest in the centre of Crawley. At 260 jobs per hectare, this was far larger than the central area of Epsom and the area of Manor Royal (the areas with the second and third highest densities) at 67 and 42 jobs per hectare respectively. In the comparator areas, every city centre had more than 70 jobs per hectare. In particular, Reading had a higher job density than the centre of Crawley with 305 jobs per hectare, whereas Milton Keynes had a lower density (155 jobs per hectare).

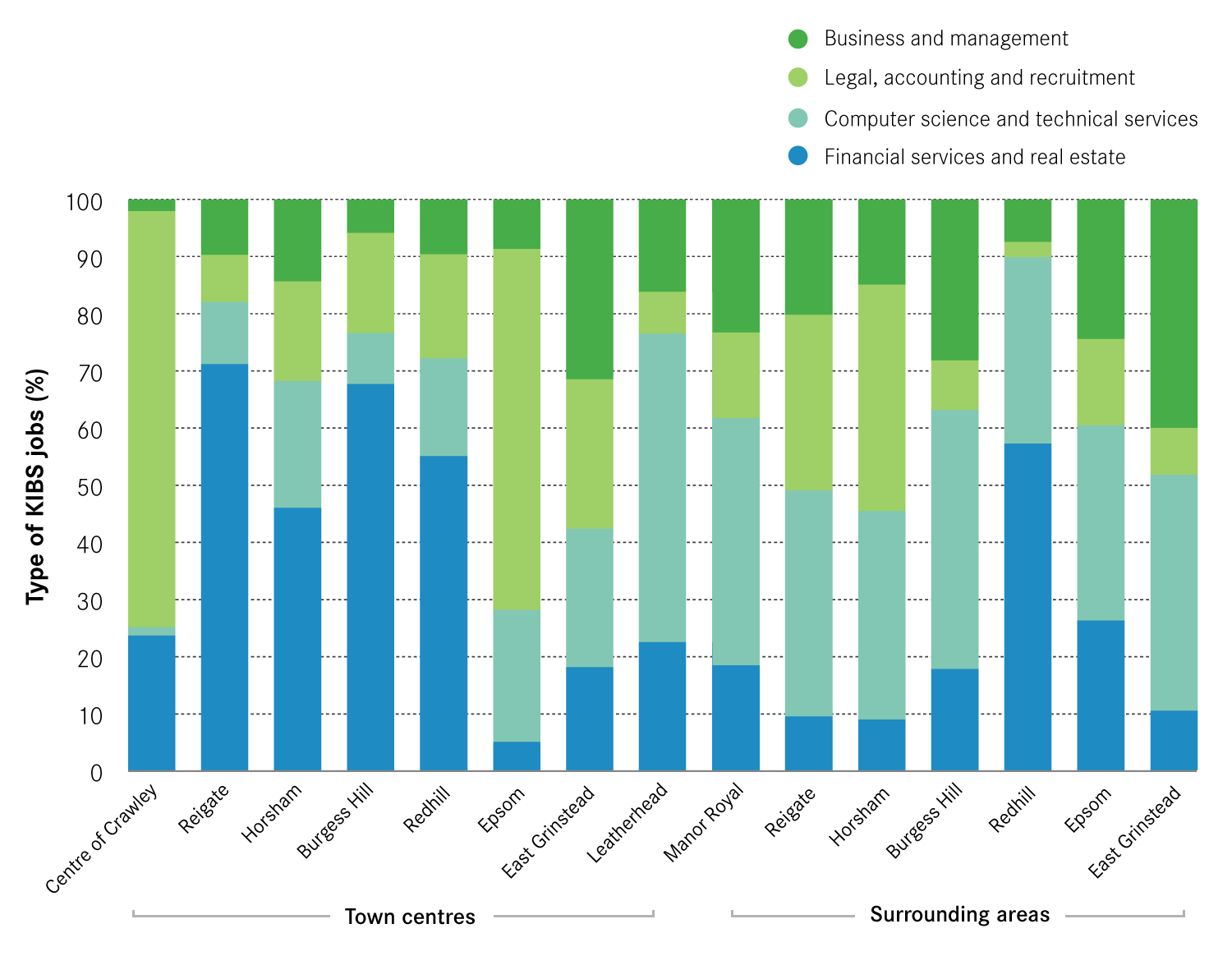

Figure 14 of course shows that density does not fully explain the geography of KIBS jobs in the Gatwick Diamond. But a further breakdown of the types of KIBS activities across the Diamond points to why this may be the case. Figure 15 separates KIBS activities into four groups for some of the areas where KIBS jobs are concentrated in the Gatwick Diamond.10

As can be seen, there tends to be a difference in the types of KIBS jobs found in the centres of the Diamond’s towns compared to their surrounding areas. In most town centres, the majority of knowledge-intensive firms operate in financial services and real estate and legal, accounting and recruitment activities. On the other hand, areas outside of these urban cores tend to be more specialised in computer science and technical services, as well as a relatively higher share of business and management activities.

This suggests that in aggregate, firms in legal, accounting and recruitment, and in financial services and real estate, tend to look for both high-skilled workers and density. But the data suggests that density is less important to business and management and computer science and technical firms. For the latter this may be explained by the nature of their activities – given that these businesses are more likely to look to patent their activities, the ability to share information with other companies in a dense environment is not likely to be as high a priority as for those businesses that look for city centre locations.

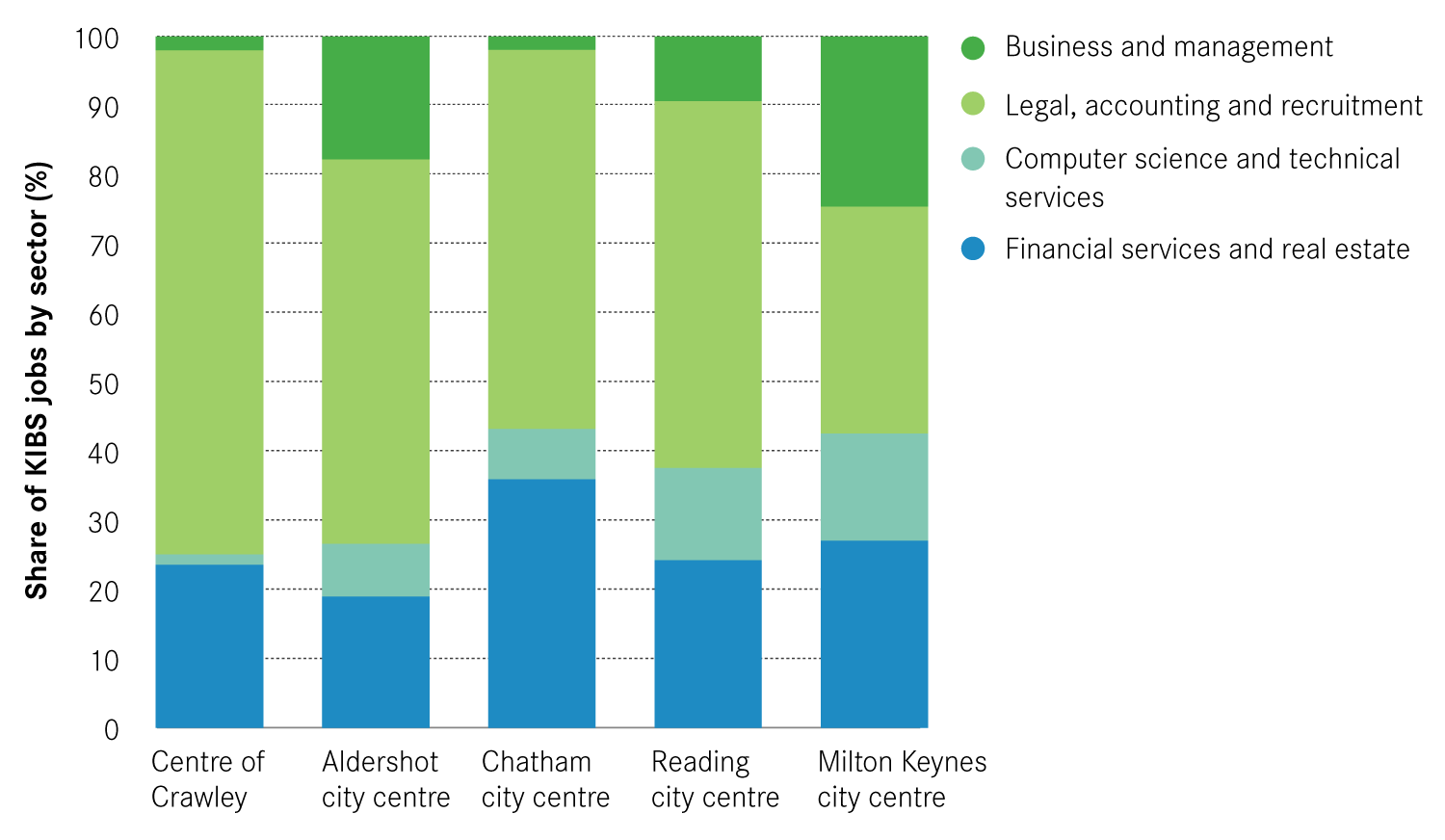

Although the centre of Crawley has a different KIBS composition to other town centres in the Gatwick Diamond – particularly its greater shares of legal, accounting and recruitment – it is much more similar to the city centres of the comparator areas. As shown in Figure 16, every city centre had a large share of legal, accounting and recruitment activities, as well as financial and real estate services – while computer science and technical services are less present. But the difference comes in the diversity of KIBS jobs: while almost three in four KIBS jobs in the centre of Crawley were in legal, accounting and recruitment, this was considerably less in every other city centre.

This suggests that while the centre of Crawley plays a similar role to comparator areas’ city centres, it has not been as successful as the city centres of Milton Keynes and Reading at attracting a broader range of KIBS jobs.12 The wider diversity of activities found in these city centres can also be explained by their relative size: the centres of Reading and Milton Keynes had 9,400 and 18,900 KIBS jobs respectively, whereas the centre of Crawley only had 3,900 KIBS jobs. However it exceeded the centres of Chatham and Aldershot (1,500 and 900 KIBS jobs respectively).

Another element can explain the location of KIBS jobs. As noted earlier, there is a particular clustering of these businesses in the north of the Diamond, which is likely to be driven by the access to a large high-skilled labour force. Such locations allow easier recruitment from the very large number of potential workers living in London: looking at commuting patterns, of all the Gatwick Diamond workers who lived in the Greater London Authority in 2011, two thirds worked in one of the three local authorities of Reigate and Banstead (29 per cent), Epsom and Ewell (21 per cent) and Mole Valley (16 per cent), all in close vicinity to London. On the other hand, only 2.6 per cent of London residents who worked in the Gatwick Diamond had a job based in Mid-Sussex, and 1.9 per cent in Horsham.

The wider benefits of a strong-performing city centre

Beyond their ability to attract investment from KIBS businesses, strong city centres have other benefits for the wider economy:13

The first is that they have a knock on impact on the high street. Large concentrations of jobs in urban centres pulls in commuters on a daily basis, which in turn creates a market for retailers, bars and restaurants.

The second is that they are more easily served by public transport. This is particularly important for lower-skilled people who are more likely to be reliant on public transport to get to work. And it also has environmental implications – it reduces the requirement for private transport.

Summary

The constituent parts of the Gatwick Diamond all make important but different contributions to its economy. The area containing Manor Royal and Gatwick Airport is the engine room of the economy, being home to the greatest share of jobs, but other areas including Horsham, Leatherhead, Reigate and Epsom are also sizable parts of the whole.

Looking at knowledge-intensive jobs in particular, it is clear that each of these locations provides different benefits for firms. This explains why the type of knowledge-intensive activities differs across different types of location.

Among knowledge-intensive locations, the centre of Crawley is an interesting case: it attracts a certain number of knowledge-based service industries, but it is still relatively small in size, both when compared to other places in the Gatwick Diamond and to city centres elsewhere. In addition, despite having a broadly similar industrial structure to other areas’ city centres, its knowledge-based services activities were dominated by law and accounting in 2016. It’s small size and relative lack of diversity suggests that the area has not been as attractive to businesses as other more successful city centres in the comparator areas.