02The geography of demand for residential and commercial space

Cities are attractive locations to both businesses and residents but do not have unlimited space to accommodate them. As a result, commercial and residential properties compete for space, especially in city centres.

This threatens the economic success of cities. Increasingly, the most high-skilled, productive firms are looking for a city centre location. Not being able to offer them appropriate commercial space has implications not only for the productivity of the UK’s cities themselves but for the national economy too.

The most productive businesses favour a city centre location

Demand for commercial space is not evenly spread across the country. Figure 1 looks at the rateable value per square metre (a proxy for rents, see Box 1) across England and Wales. As can be seen, prices are highly variable, suggesting businesses have a stronger preference for locating in some areas over others.

Prices tend to be highest in cities. Cambridge and London are the most expensive business locations, with a median rateable value of £192 per m2, compared with the English and Welsh median of £81 per m2. Within cities, there is great variation in prices. In London, prices are above £600 per m2 in parts of the boroughs of Hammersmith and Fulham and Kensington and Chelsea. In comparison, prices fall below £80 per m2 in parts of Barking and Dagenham

and Havering.

Figure 1: Median rateable value per m2 of commercial property, 2015

In particular, city centres contain some of the most expensive commercial properties. London has by far the most expensive city centre, with a median rateable value of £424 per m2. The median rateable value in the city centre of Cambridge is £250 per m2, compared to £161 per m2 elsewhere in the city, and in Manchester, the median city centre price is twice that of the suburbs (£146 per m2 and £71 per m2 respectively). In total, all of the 58 city centres in England and Wales have a higher median commercial property price than their respective suburbs, except for Aldershot and Portsmouth.

A number of commercial areas within suburbs have particularly high prices too. These usually correspond to shopping centres and retail outlets, a number of which can be seen on the map, such as Bicester Village near Oxford (£191 per m2) and White Rose near Leeds (£374 per m2). A few of London’s satellite towns, such as St. Albans and Guildford, also stand out as having relatively expensive commercial space.

Businesses favour urban areas because they provide one major benefit —proximity. For a large number of workers and firms, cities offer proximity to shared infrastructure and to integrated supply chains. For this reason, 60 per cent of jobs in Britain were located in cities in 2016.

In addition, the density in city centres provides businesses with access to knowledge. Close geographical proximity to other firms encourages innovation, creates deep networks and increases information sharing.2 These benefits are particularly important to knowledge-intensive, high-skilled industries, such as finance or marketing.

The benefits on offer in city centres are strong enough to persuade firms to pay a considerable premium to be there.3 High demand from firms for these central locations pushes up the price of property. On average, the price of a commercial building in a city centre is double the price of one in the suburbs, as shown in Figure 2.4 Despite covering just 0.1 per cent of Britain’s land, city centres were home to 41 per cent of all knowledge-intensive jobs in 2015. For these businesses, it is worth paying for access to knowledge.5 On the other hand, firms that rely less on knowledge prefer to locate in the suburbs and hinterlands where they can access cheaper, larger premises.

Figure 2: Median commercial prices by degree of urbanisation, 2015

These high-skilled firms generate demand for local services, creating jobs in the city centre.6 Policymakers should encourage these industries to locate in city centres to ensure they succeed and this benefit is realised.

Residents are attracted to both city centre and suburban locations

The distribution of residential prices is slightly different to commercial prices. Figure 3 shows how the median price paid per m2 for housing varies across the country. The map shows four broad price levels, centred on London and decreasing with distance from the capital.

Figure 3: Median residential price per m2, 2017

First, the most expensive properties are in the capital. In most of central London, prices are above £6,200 per m2, with values peaking in Soho and Marylebone (at around £20,000 per m2), as well as parts of Kensington, Chelsea and Pimlico (above £18,000 per m2). Second, central London is surrounded by a ring of suburbs where prices range between £3,800 and £6,200 per m2.

The third price level highlights that property remains relatively expensive across the Greater South East. Here, residential property prices range from £2,300 to £3,800 per m2. In comparison, prices in the rest of England and Wales tend to be below £2,300 per m2, making up the fourth level.

Within all four levels, cities stand out as having higher prices than their surroundings. This is the case with both the southern cities of Oxford, Cambridge and Brighton – where average prices in some areas can exceed £5,000 per m2 – and several cities in the Midlands and the north of England, such as Birmingham, Sheffield, Manchester and York, where prices can reach above £3,000 per m2.

In many cities, the city centre is relatively more expensive than its surroundings. In Manchester city centre, one square metre of floor space is typically worth around £3,100, compared to £1,800 for the city as a whole. In Leeds, the city centre costs around £2,300, compared to £2,000 across the whole city.

But there are also pockets of high prices in suburban areas. In the affluent suburbs of Solihull, which surround Birmingham, and Stockport, on the outskirts of Manchester, median prices can exceed £3,000 per m2.

The result is that house prices are more uniform across different geographies than commercial prices. While city centres remain expensive areas to live, house prices do not reduce as significantly as commercial prices in less urban locations. As Figure 4 shows, house prices (per m2) in city centres are on average only 10 per cent higher than suburban prices.

Previous research shows that one of the main draws to city centre living is proximity to jobs.7 The clustering of jobs in a city centre creates a consumer market which strengthens the city centre’s amenity offer, such as retailers and restaurants. In turn, this makes city centres more appealing places to live, particularly young professionals.

The suburbs offer different benefits and drawbacks as places to live. While they don’t offer immediate access to the same range of amenities, they do offer access to larger houses and more green space and are less noisy. These benefits tend to appeal to older residents. As a result, demand to live in both parts of the city tends to be more even.

Figure 4: Median residential prices by degree of urbanisation, 2016-2017

Competing demands for city centre space threaten cities’ roles as places of production

The varying patterns shown in Figures 1 and 2 demonstrate that businesses and residents do not always have the same location preferences. But city centres are attractive to both businesses and residents which means they compete for the limited space on offer. This competition forces difficult planning decisions about which type of property use to prioritise in the city centre.

Strong residential demand can squeeze out commercial space. City centres do not have unlimited land so choices must be made about how to allocate it between the two property uses. There is a risk that priority is given to housing due to the pressure on local authorities to meet specific targets.

But commercial space must be the priority in city centres. Knowledge-intensive firms thrive in these central locations, and generate jobs for the local economy.

Without this space, a city’s role as a place of production is threatened. The attractiveness of the city centre to businesses will be compromised if firms cannot access the premises they need. It is these high-skilled, knowledge-intensive industries that drive productivity growth in the national economy, so restricting their growth is not only bad for the city, but also the UK’s prosperity.

Box 1: Measuring commercial and residential property prices

In this report, commercial property prices are measured using rateable values. These values, which are estimates of the annual rental values businesses pay, are periodically calculated by the Valuation Office Agency (VOA) to assess each property’s business rates bill. Figures presented here use VOA data that was published in 2017, but report rental values that were estimated in 2015.

Residential property prices were calculated by combining two datasets: Land Registry’s Price Paid Data, which collects information on residential transactions including price of purchase, and the Energy Performance Certificate dataset, which provides floor space for a large sample of properties across the country. Two years of residential transactions (2016 and 2017, uprated to 2017 prices) have been compiled to obtain a larger sample size.

The two prices measure different things but their relative size can be compared. Rateable values reflect the annual rental value of properties, while residential property prices measure their selling price.

Prices are expressed as median prices rather than mean. This is to provide a more accurate picture of the property market by giving less weight to outliers. For instance, an exceptionally high one-off transaction could affect average prices per m2 in one area, therefore not reflecting the value of most other properties. Median averages are frequently used to express property prices, such as in the ONS HPSSA publications.

High-skilled city centres have the most intense competition for space

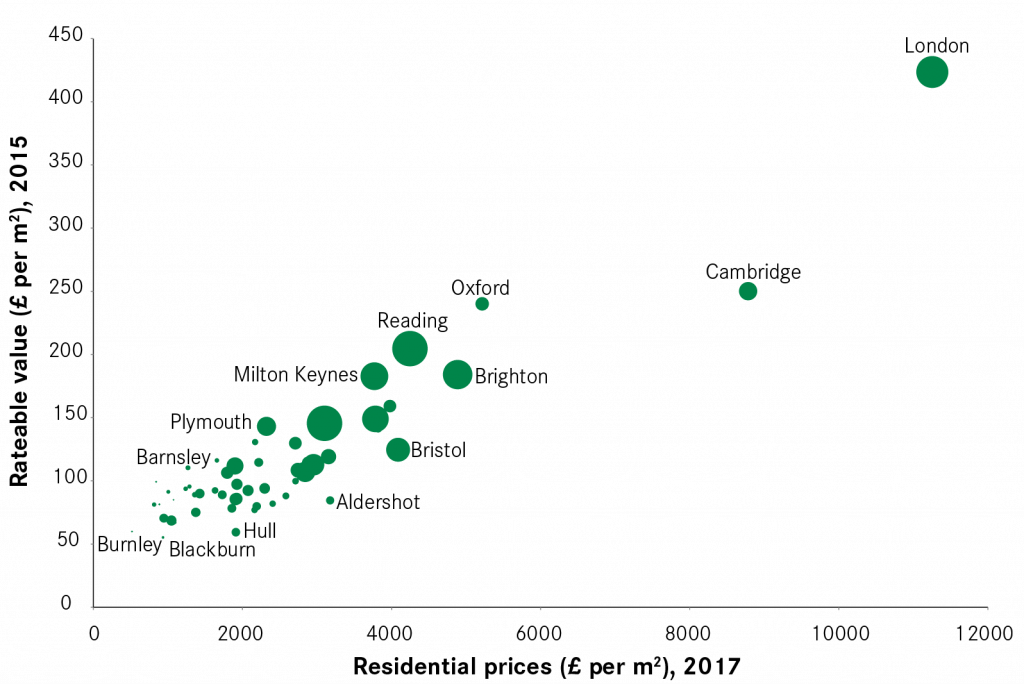

Not all city centres experience this competition for space to the same extent. Figure 5 illustrates this variation by comparing the price of residential and commercial property in each UK city centre.9 The two prices are closely linked: the higher the cost of housing in a city centre, the higher the cost of business space.

City centres in the top right – London, Cambridge, Oxford – have very expensive residential and commercial property, while city centres in the bottom left have low prices for both — Burnley, Blackpool and Blackburn, for example.

Figure 5: Residential and commercial property prices by city centre

City centres with the largest shares of high-skilled jobs tend to have the most expensive property. As explained above, firms providing these jobs choose city centre locations because of the knowledge spillovers on offer there. But as Figure 6 highlights, not all city centres offer this benefit to the

same degree.

Workers with a degree account for 46 per cent of Reading city centre’s workforce and 55 per cent in Oxford’s city centre, as shown in Figure 6. This reflects the large number of high-skilled jobs in these cities. By contrast, only 21 per cent of those who work in Birkenhead city centre are graduates, while this figure is 32 per cent in Derby.

Figure 6: Share of city centre workers with a degree compared to property prices

Many high-skilled workers choose to live in the city centre. Figure 7 highlights how the city centres with the most expensive property also tend to have the highest proportions of residents with a degree. In Bristol for instance, 42 per cent of the city centre population are graduates and half of city centre residents in Reading have a degree. Graduates are drawn to city centres that offer close access to the high-skilled jobs they work in.

Figure 7: Share of city centre residents with a degree compared to property prices

Looking at these trends over time shows that in recent years many successful city centres have grown in popularity as places to work and places to live. Figure 8 shows the relationship between growth in residents and growth in jobs in city centres across the country. The size of the bubbles represents the price of commercial and residential property (measured using an index of the two sets of prices combined) in the city centre: the larger the bubble the higher the price.

Several groups of city centres are visible:

- Quadrant A: city centres with more jobs and more residents

- Quadrant B: city centres with more residents but fewer jobs

- Quadrant C: city centres with fewer jobs and only slow growth in residents

- Quadrant D: city centres with more jobs but slow growth in residents

Figure 8: Property prices compared to resident and job growth in city centres

The fastest growing city centres in recent years (Quadrant A) currently do not have the highest prices. Manchester and Leeds, for example, saw 84 and 34 per cent increases in city centre employment between 1998 and 2015. In the same period, their populations increased by 149 and 151 per cent, with new residents – many of whom were young professionals – likely to have been attracted in by the job opportunities and amenities on offer. The fact that they are not the most expensive city centres suggests there has been enough space to accommodate this growth. In Manchester, for example, the city centre has made room for an additional 20,000 residents (since 2002) and 70,000 jobs (since 1998).

As growth continues, property prices will likely increase as space becomes more limited. While these cities have not had to make specific choices about the use of land in their city centres in the past, this is likely to change in the future if they continue to be successful.

A number of cities in Quadrant D, such as London and Brighton, have not seen strong jobs growth matched by strong residential growth. And yet residential prices in these city centres are high, suggesting that residential demand is strong. This points to a restriction in space in these city centres, unlike those city centres in Quadrant A. Accommodating more residents here will require building upwards, increasing density.

City centres in Quadrant B have seen the opposite trend, experiencing strong residential growth in spite of very poor jobs growth. Much of this is due to growing student populations. An examination of Census data, which gives greater detail on the characteristics of residents, shows that in Sheffield the increase in student residents between 2001 and 2011 was equivalent to three quarters of the city centre’s population growth, while in Leicester it was 63 per cent.

Population growth due to increases in student numbers is beneficial to these city centres – it will increase footfall and bring activity back into them. The challenge will be to guard against too much commercial space being given over to residential. If their city centre economies are to improve, having commercial space available will obviously be important.

Finally those cities in Quadrant C have seen very sluggish growth in both residents and jobs. Looking at the varying prices of space within this group suggests that this has occurred for two different reasons. In inexpensive city centres, such as Barnsley and Mansfield, this is likely to be because they have not been very attractive to high-skilled business investment (reflected in their low shares of higher-skilled jobs, as shown above), and this in turn has meant that residential growth has been weak (and there has been little demand from higher-skilled workers to live there, shown by the low share of degree-holders living in these city centres).

In a city centre like York, where property is relatively expensive, its low growth in part may have resulted from restrictions in space as a result of its historic centre. This makes York much more like cities in Quadrant D, such as Cambridge, where constraints on the availability of space requires choices and trade-offs about how land is used.

As the UK continues to specialise in ever more knowledge-based activities, demand for a city centre location is likely to continue to increase. In weaker city centres, the challenge will be to get growth going, making them more attractive to higher-skilled business investment. But the choice between how space is used — either for commercial or residential — is not likely to be one that requires a trade off because of the availability of land.

In more successful city centres in Quadrants A and D, the challenge will be to continue to increase the supply of commercial and residential space to match rising demand. Within this, commercial space should be prioritised over residential space.

Not providing the required commercial space in a city centre will affect the ability of a city to attract higher-skilled activities, with implications for productivity, jobs and wages. And because in many cases the popularity as a place of residence results from the success of a city centre as a place of production, policy makers need to make sure that the rise of the former does not impact on the latter.

Residential space should still be provided in city centres. But this will need to be done in balance, and will require choices and trade-offs to make sure that the city centre economy is still able to grow. This has been a challenge that central London has faced for many years. And it is likely to be something that Manchester and Birmingham city centres will increasingly have to deal with.